Life insurance: is a life insurance policy designed to help you avoid financial problems and protect your family in the event of your death. It helps your family by freeing them from money related troubles or stress and helps them in moving forward with their life.

If you want to be sure about what will happen to my family members after your demise, how will the Aarti date of my dear one be safe. So this life insurance can be a good investment that can be a good option for you because there are many types of such policies.

Which can provide relief from financial problems.If you also need life insurance, then let us know in depth about these policies and know how many types of policies are there which can secure the life of our loved one.

Also Read: Should I Get Health Insurance?

What is life insurance?

Life insurance is a contract between an insurance company and an individual in which, in exchange for regular premium payments, the policy is issued to the beneficiaries of the policy holder’s policy to protect his or her financial condition upon his or her death. has been constructed. Life’s insurance is a policy that helps your loved one and your family cope with the financial situation after your demise.

How does Life Insurance work?

When you want to take or apply for a life’s insurance policy, you have to make regular payments. Which we express as premium. The benefit of paying the premiums you pay regularly helps and helps your loved ones to improve their financial condition after your demise.

The premium amount paid by you is paid to your loved ones as a lump sum after your death. So that their economic condition can improve. Your loved one can use the money from the policy to help pay for expenses like mortgage loans and college tuition, or for your funeral.If you die suddenly, your family will be better off financially.

- Premium payments: You have to make regular payments of a fixed amount to keep the policy in force.

- Underwriting: The insurer assesses your risk based on your lifestyle, your health, and your age to determine your premium.

- Death benefit: After your sudden demise, insurance companies make a lump sum payment of the agreed amount to your loved one and beneficiaries.

Types of life insurance ?

There are many types of life’s insurance policies which cater to different preferences as per the need.

01.Term Life Insurance

With this life insurance policy you can get coverage for a fixed period of time. The time limit of this policy has been fixed between 10 years to 30 years. In this policy, death benefit is paid only if the policy holder dies within this time limit. Term Life Insurance mostly comes with cost-effective premium rates.

02. Whole Life Insurance

Whole life’s insurance is a policy that provides coverage for your entire life. A cash basic component is included in this policy. Whose price keeps increasing with time. This cash principal can be borrowed and withdrawn midway. However, whole life insurance policies have higher premiums.

03.Universal life insurance

Universal life’s insurance is a flexible type of life insurance policy that can allow you to increase or decrease your premium payments. And may allow the premium to change to suit your circumstances.If you change the premium, it affects the amount you will receive after your death.

04. Variable life insurance

Variable life insurance policy is a type of policy that allows the policyholder to invest his or her cash principal in different investment options. This means the death benefit and cash value may fluctuate depending on investment performance.

How much does Life Insurance cost?

When determining whether life’s insurance is worth it, it is important to consider the cost or payments you will pay for the policy. There are different types of life insurance costs and they are determined by many factors.Such as gender, health condition, your age and the amount of coverage. The healthier and younger you are, the better you will be able to avail. In simple language, life insurance depends on your age and health.

- Age

- health

- coverage amount

- type of policy

Is life insurance Worth it ?

Yes’ If your life partner and your children are dependent on your earnings, life insurance can provide the necessary financial support. This coverage can help the beneficiaries repay the loan and ensure that your family is not burdened with financial liability.

This policy helps in improving the financial condition of the beneficiaries including funeral costs, children’s college fees and financial condition related to education.

More Read : Is Travel Insurance Worth It?

Benefits of getting Life Insurance?

Life’s insurance policy helps to improve the financial condition of the loved ones and beneficiaries of Insurance India. A life insurance policy helps to cover their loan and repay the loan they have financed.And helps in solving financial problems related to the education of their child and their children. Solving all these problems frees the beneficiaries from future problems.

- Financial security

- depth coverage

- child education

- tax benefits

- peace of mind

Pros and cons of life insurance?

Pros or cons helps you decide whether to buy life’s insurance or not. In many cases the benefits of having life insurance outweigh the benefits but still life insurance may not be right for everyone so the point to consider is whether you should get life insurance.

Pros of life’s insurance

| financial protection for loved one: Variety of options cash value tax benefits |

Cons of life’s insurance

| Cost to abserve cost to buy incresed with age medical history and increase life insurance quotes |

-

Darby Camp Net Worth 2025: Darby Camp is a name synonymous with talent and charm in Hollywood’s young generation of […]

-

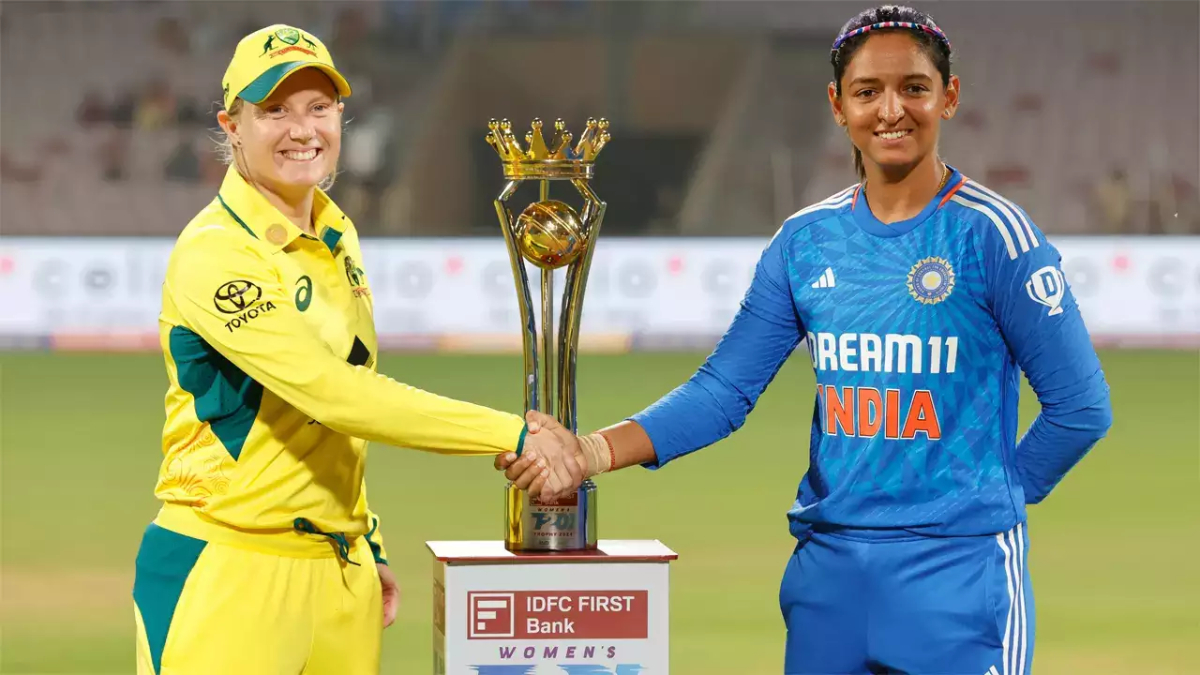

Australia Women vs India Women: Australia’s women’s cricket team continued their dominant form in the ODI series against India with […]

-

Disney princesses have long been an essential part of our childhoods, inspiring millions worldwide with their beauty, strength, and grace. […]

-

Cailey Fleming Net Worth : Cailey Fleming is a rising star in the Hollywood industry, recognized for her stellar performances […]

-

Criminal Defense Attorney: When we the Choosing the right criminal defense attorney is one of the most important decisions you’ll […]

-

Brain Time to Recharge: In today’s fast-paced world, it’s easy to neglect our mental health. With constant work deadlines, social […]

-

Personal Injury Lawyers: When accidents or injuries disrupt your life, personal injury lawyers step in as your legal advocates. These […]

-

Chess Championship 2025: At just 18 years old, Gukesh is on an ambitious mission to make history as the youngest […]

-

A DUI accident lawyer specializes in representing individuals who have been involved in accidents where Driving Under the Influence (DUI) […]

-

As a pet parent, you want to ensure that Is Pet Insurance Worth It your furry companions receive the best […]